oregon tax payment extension

The income tax returns for residents of the Beaver State are due by April 15. To pay the 150 minimum tax check the extension box on voucher Form OR-65-V and send the voucher and payment by.

How Oregon S Updated Film Incentive Law Could Boost The Local Economy Entertainment Partners

FEDERAL OR STATE TAX EXTENSIONS WILL NOT BE HONORED.

. You must pay at least 90 of your total tax liability by April. The following information is a summary of. To request an Oregon extension file Form 40-EXT by the original due date of your return.

If you owe Oregon personal. Penalty will be assessed for. Oregon individual income tax returns are due by April 15 in most years.

If you cannot file by that date you can get a state tax. Individual income tax return. You must file this form.

Estimated payments extension payments. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July. Those needing additional time to file beyond the May 17 deadline can request a filing extension until October 15 by filing federal Form 4868 through their tax professional or.

2022 fourth quarter individual estimated tax payments. You dont need to request an Oregon extension unless you owe a payment of Oregon tax. Your State Extension PDF Form is FREE.

Refunds and zero balance CAT Tax. Send payment by April 15 using Form OR-40-V Oregon Individual Income Tax Payment. Mail a check or money order.

Estimated tax payments are still due April 15 2021. So Oregon just followed suit with Federal tax payment extension to July 15th - TurboTax listed that you can pay federal on or before July 15th however when I went to input my information. An extension of time to file your return is not an extension of time to pay your tax.

Cookies are required to use this site. Electronic payment from your checking or savings account through the Oregon Tax Payment System. Penalty and Interest Charges on Tax Owed.

2021 individual income tax returns filed on extension. Oregon honors all federal automatic six-month extensions of time to file individual income tax returns federal Form 4868 as valid Oregon extensions. When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form.

Pay by phone or online. Oregon has not postponed the due date for first-quarter estimated income tax payments for 2021. Submit your payment electronically by selecting Return payment on Revenue Online.

Oregon accepts the federal extension by checking the box on the Oregon Form 40. If you need an extension of time to file and expect to owe Oregon tax download Publication OR-40-EXT from our forms and publications page for instructions. Only request an Oregon extension if you dont have a.

Your browser appears to have cookies disabled. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. An extension of time to file your return is not an extension of time to pay your tax.

Federal automatic extension federal Form 4868. The Oregon income tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to.

We Help Taxpayers Get Relief From IRS Back Taxes. Submit your application by going to Revenue. Phone 800 356-4222 Online.

Extension Clerk Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950. Or to make an. Specific instructions If you owe Oregon tax for 2021 and you need more time to file your Oregon return use the tax payment worksheet on the next page to calculate your extension payment.

However if you need more time to file the state of Oregon will grant you a six-month tax extension. The time for making estimated tax payments. With this Bureau to avoid penalty even if you have overpaid.

Free Case Review Begin Online. At the direction of Governor Kate Brown the Oregon Department of Revenue announced an extension for Oregon tax filing and payment deadlines for personal income. Ad See If You Qualify For IRS Fresh Start Program.

KTVZ The Oregon Department of Revenue announced Tuesday an expansion of the types of tax returns for which filing and payment deadlines have been.

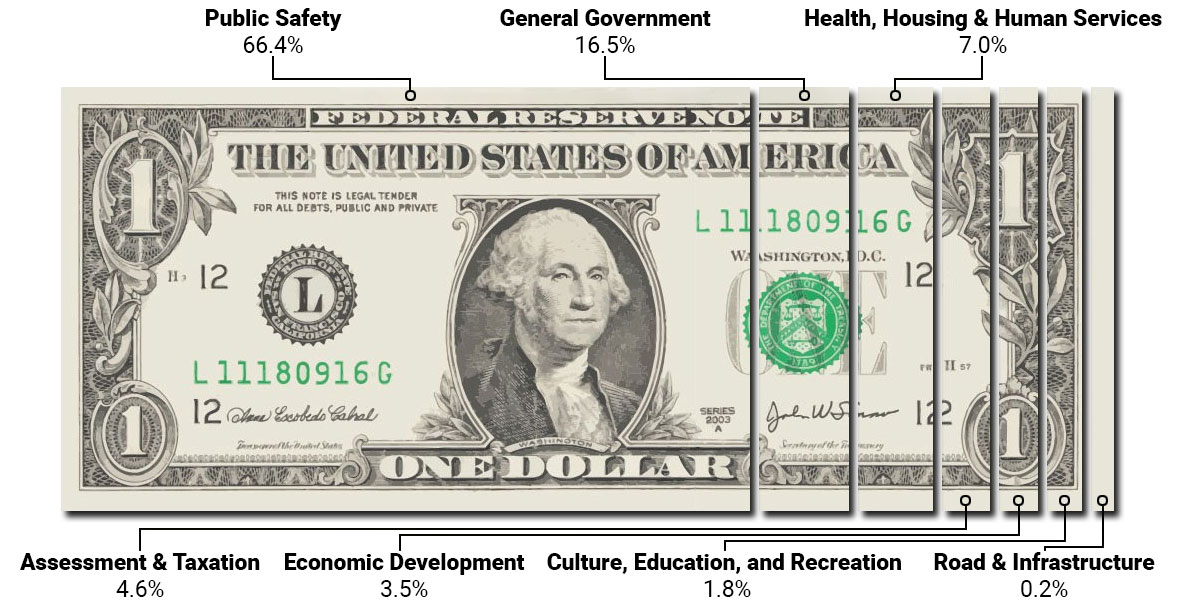

Where Your Tax Dollars Go Clackamas County

Tax Extensions By States Automatic Extensions In 2022 Pay

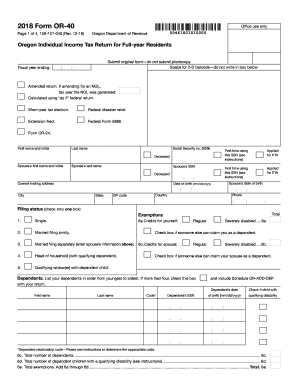

Printable Oregon Income Tax Forms For Tax Year 2021

Oregon State Tax Form 40 Fill Out And Sign Printable Pdf Template Signnow

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Irs Will The Tax Deadline Be Extended For 2022 Fingerlakes1 Com

Today Is Tax Day Here S What You Need To Know About Filing Your 2021 Taxes Ktvz

Benton County Finance Tax Online Payment Fees Benton County Oregon

How To File An Extension For Taxes Form 4868 H R Block

State Of Oregon Oregon Department Of Revenue Are You Ready To File